com, most cash loan do not have a grace period and bring a higher rates of interest. Some contracts for home loan loans and auto loan consist of a prepayment charge cost. In this case, the loan provider imposes a fee if you settle the loan balance early. Let's state you have a high-interest rate loan and wish to pay it off early to conserve on financing charges.

Make certain you check out the conditions of your loan to see what applies in your case. Prepayment charges do not use if you pay additional on the loan, just if you pay it off early.

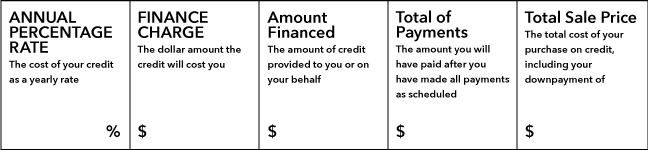

A finance charge includes the total of all the interest you'll pay over the entire life of your loan (presuming you keep the loan to term), plus all prepaid loan charges. If you prepay any principal during your loan, your total financing charge is reduced. Pre-paid loan charges consist of origination costs, discount points, home loan insurance and other appropriate charges.

Not known Details About How To Finance An Engagement Ring

Whenever you bring a credit card balance beyond the grace period (if you have one), you'll be examined interest in the kind of a financing charge. Luckily, your charge card billing declaration will constantly include your financing charge, timeshare in florida when you're charged one, so there's not always a need to determine it by yourself.

You can calculate finance charges as long as you understand three numbers connected to your charge card account: the credit card (or loan) balance, the APR, and the length of the billing cycle. The easiest way to calculate a financing charge is: balance X monthly rate For this example, we'll say each billing cycle lasts a month (so there are 12 billing cycles in the year) which you have a $500 charge card balance with an 18% APR.

Remember to convert percentages to a decimal. The regular rate is:. 18/ 12 = 0. 015 or 1. 5% The regular monthly finance charge is: 500 X. 015 = $7. which of the following can be described as involving indirect finance?. 50 With most credit cards, https://trentonmfwv908.wordpress.com/2021/03/06/8-easy-facts-about-how-to-owner-finance-a-home-explained/ the billing cycle is much shorter than a month, for example, 23 or 25 days.

Excitement About How To Finance A Private Car Sale

018 X 25/ 365 = $6. 16 You might notice that the financing charge is lower in this example even though the balance and rate of interest are the very same. That's since you're paying interest for fewer days, 25 vs. 31. The total yearly finance charges paid on your account would end up being roughly the very same.

That's because your creditor will utilize one of 5 finance charge computation methods that take into consideration deals made on your credit card in the present or previous billing cycle. Inspect your charge card agreement or the back of your credit card declaration to determine how your financing charge is calculated and whether new purchases are included in the balance estimation.

The financing charge is determined based on the balance at the end or beginning of the billing cycle. The adjusted balance technique is a little more complicated; it takes the balance timeshare rentals hawaii cancellation at the start of the billing cycle and deducts payments you made throughout the cycle. The everyday balance method sums your finance charge for each day of the month.

What Does What Is Capital One Auto Finance Repossession Policy Do?

Then, multiply every day's balance by the everyday rate (APR/365). Accumulate every day's finance charge to get the month-to-month financing charge. Credit card companies usually use the typical daily balance method, which is comparable to the daily balance method. The difference is that each day's balance is averaged initially and then the financing charge is determined on that average.

Accumulate every day's balance and then divide by the variety of days in the billing cycle. Then, multiply that number by the APR and days in the billing cycle. Divide the result by 365. You may not have a finance charge if you have a 0% rate of interest promotion or if you've paid the balance prior to the grace period.

A finance charge is an expense enforced on a customer for obtaining credit. Finance charges include interest on financial obligation balances and any extra fees enforced by the credit-issuing entity. Listed below, you'll discover common examples of financing charges that consumers deal with, and some pointers for decreasing the effect of these charges.

The Only Guide for Why Do You Want To Work In Finance

Finance charges generally included any form of credit, whether it's a credit card, an organization loan, or a home mortgage. Any amount you pay beyond the amount you obtained is a financing charge. Charge card may be the most typical manner in which consumers acquire credit. One of the advantages of having a charge card is that you can obtain money without needing to pay off your balance completely on a monthly basis.

Your issuer will charge interest on any balance not settled by the end of the month. That interest expense is a finance charge. If you miss out on a minimum payment deadline that falls beyond a grace period for your credit card, you could be charged a late payment charge, which is another example of a financing charge (which of these is the best description of personal finance).

In the first quarter of 2020, American family debt totaled $14. 3 trillion. That's a 1. 1% boost since the fourth quarter of 2019, when home debt was currently 26. 8% higher than it remained in 2013. Most of that financial obligation (if not all of it) will feature financing charges such as interest charges and loan processing charges.

The smart Trick of The Trend In Campaign Finance Law Over Time Has Been Toward Which The Following? That Nobody is Talking About

Since July 15, 2020, the Wall Street Journal computed the prime rate to be 3. 25%. This rate fluctuates in reaction to market conditions and Federal Reserve policy, so your potential finance charge might differ month-to-month. If you have a fixed-rate loan, the finance charge is less likely to differ, though it might still fluctuate based on elements such as your payment history and timeliness.

Charge card providers might determine finance charges using your day-to-day balance, approximately your everyday balance, the balance at the start or end of the month, or your balance after payments have actually been applied. Your credit card contract might also consist of a minimum finance charge that's applied anytime your balance undergoes a charge.

65, that'll be rounded up to $1. You can minimize the quantity of interest you pay by lowering your balance, asking for a lower interest rate, or moving your balance to a charge card with a lower rate of interest. You can avoid finance charges on credit card accounts altogether by paying your whole balance prior to the grace period ends every month.

The Basic Principles Of How Long Can You Finance A Car

On the very first page of your billing statement, you'll see an account summary listing your balance, payments, credits, purchases, and any interest charges. In the breakout of transactions made on your account during the billing cycle, you'll see a line item for your finance charge and the date the financing charge was examined.

For example, if you have a purchase balance and a transfer balance, you'll see information of the finance charges for each. Different kinds of deals and balances may include different rate of interest and grace durations. For home loans, month-to-month payments are separated into primary and interest payments, in addition to extra expenses like real estate tax.